Noteworthy Issues

Week 1 of the Legislative Session

The 2023 General Session has begun! What an action-packed week it has been. I am looking forward to the rest of the 45 days with expectations that we will be able to make changes to benefit Utahns in many areas. I expect major policy changes in areas like education, water, taxes, elections, and many more.

During the first week it has become customary to attend a Legislative Reception at the Governor’s Mansion. This is a great opportunity for leaders from the executive and legislative branches to renew contact and enjoy each other’s company.

More Tax Cuts are in the works!

Last year, we delivered the largest tax cuts in Utah history, and this year, I believe we can top that. While there is still a fair amount of negotiating happening, I anticipate a significant reduction in the income tax rate and some meaningful relief for skyrocketing property taxes. Personally, I also want to see the elimination of the unfair double-taxation of social security benefits and have sponsored a bill to do away with them.

Teacher Salaries and Expanded Flexibility for Parents

As you have heard, HB215 passed the House this week and was forwarded to the Senate for further consideration. This bill provides up to $42 million in scholarship funds that parents can use to seek flexible opportunities to meet their child’s educational needs. It also includes almost $200 million in direct salary increases for Utah’s teachers. I was a solid No on the original version of the bill that was introduced.

While I am supportive of choice generally, there were problems with that aspect of the bill. I am also a proponent of additional funding for education, but I don’t support “strings attached” funding and micromanaging employment policies and decisions by local districts. I wanted to see more accountability and more flexibility.

As you can appreciate, voting “No” as a matter of principle is occasionally the right thing to do, but sometimes it is more effective to negotiate a better bill, even if you don’t get everything you want. That’s the position I took in this case – joining with a group of education-minded legislators to negotiate changes that made the bill much better in several aspects. With those concessions, we agreed to lend our support to the greatly improved, but still imperfect bill. Sometimes using influence to make things better is preferable to trying (and failing) to kill a bill.

Recognition as a Friend of the Utah Taxpayer

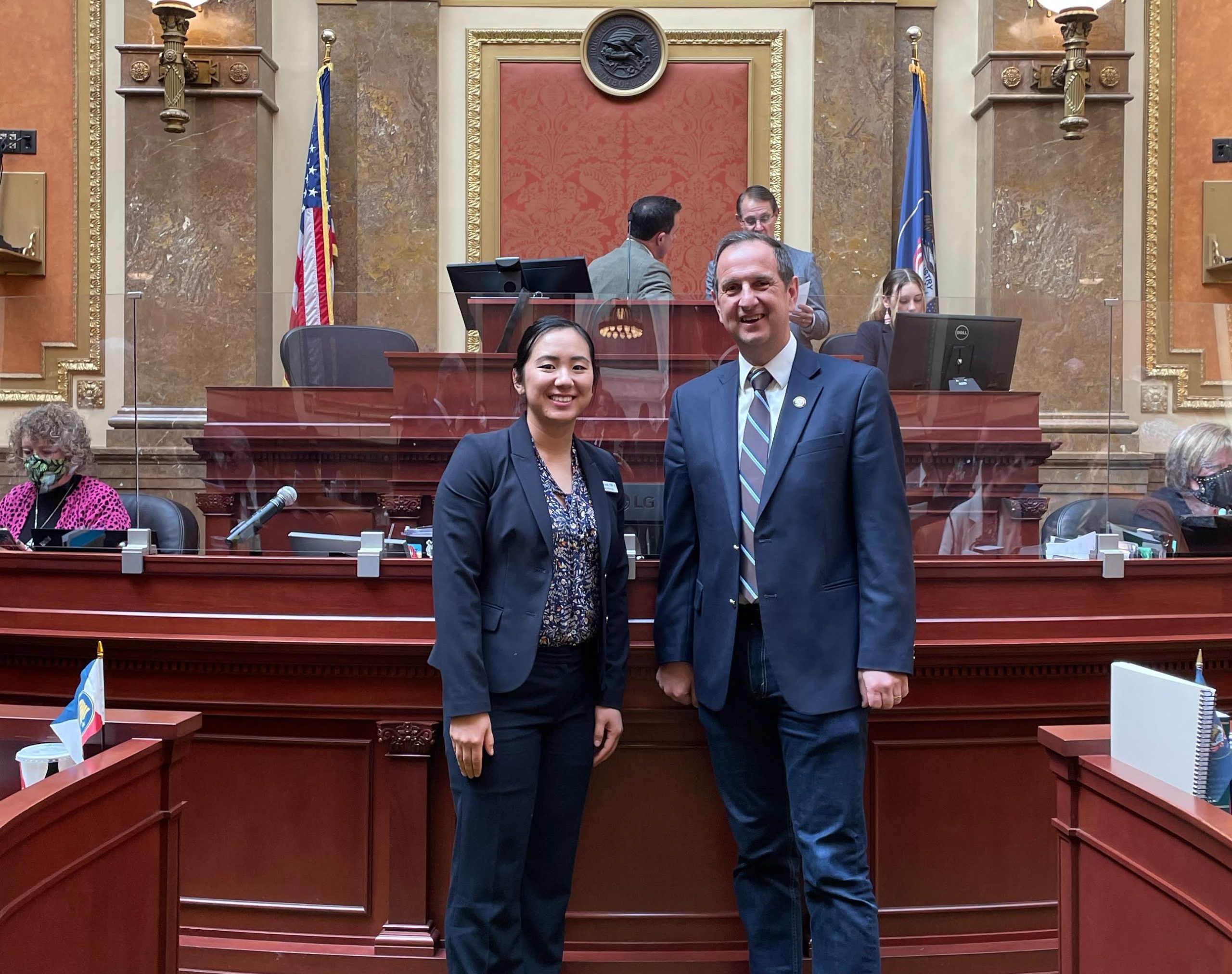

I was very pleased to be recognized by the Utah Taxpayer Association as a “Friend of the Utah Taxpayer.”

My Bills – A Status Update

This year, I have an unusual number of priority bills that I will be sponsoring this session. Here is a quick update of the early status:

HB 26 – License Plate Amendments – Simplifies the processes for requesting and implementing changes to our license plate programs.

Assigned to the Transportation Committee.

HB 75 State Commemorative Periods Amendments – Clarifies what a commemorative period is and how they should be declared.

Passed the House and is now in the Senate

HB 35 Unfair Practices Act Amendments – Repeals this antiquated and duplicative section of the code so businesses will have a better idea of what the law requires

Will be consider by the full House soon

HB 116- Intergenerational Poverty Solutions – Provides an incentive program to encourage parents of low income children to save for their post-high school training and education

Status: House Rules Committee

HB 135 – State Holiday Amendments – Modernizes how state government treats state holidays to provide increased access to the public for needed services and provide a more valuable benefit for state employees at no extra cost

Status: House Rules Committee

HB 135– State Holiday Amendments

Scheduled to be heard in committee on Monday

HB 159 – Health Care Professional Licensing Requirements – Allows Utahns more access to telehealth providers by reducing the barriers that prevent them from being available

Status: House Rules Committee

HB 213– Social Security Tax Credit Amendments – Would repeal the unfair double-taxation of Social Security benefits

Status: House Rules Committee

Thanks for your diligent work in the legislature. I do have to disagree with the income tax cut proposal of less than one percent. For a taxpayer and senior, I see no real benefit to this tiny cut.

With the pressing needs for drought relief, transportation and education, these funds could be better spent on real issues. Even if spent on grants to farmers for “smart” irrigation systems, it would be worth it.

Like you, I was not pleased that educational “vouchers” came back again, this time cloaked in additional funds for pay increases for teachers.

I am not happy to see that HB215 will take my tax dollars and pay parents to send their children to private and parochial schools. The combining of teacher raises with the vouchers was an underhanded play. Which politician wants to be identified as voting agains teacher raises? Not one I would bet.

I am also troubled about legislators making personal medical decisions for women and for the LGBTQ community.

Thank you so much Rep Thurston, we have great respect and appreciation for your fine work!

Hurrah for HB 213! Thank you.

Your new website photo looks good. And I like the photos on duty in the capital also.

Carry on.

Thank you for your efforts! You are on the right track for these bills.

Norm–I’m grateful to have someone with your values and expertise representing us.

Yes. Thank you for your efforts. I am opposed to HB 125. I am for teachers getting a raise that they very much deserve. But I am opposed to tax payer dollars being used to fund at home and private schooling. Tax payer dollars should not be removed from our public schools.

Thank you, Norm, for sponsoring HB213. I know I’ve been harping on this for the last few years since I retired. I appreciate you trying to get this double tax completely removed to benefit those of us on Social Security. Thank you again.